Header Title

Making financials useful for us mere mortals

Financial planning may be necessary, but for many startups and modern flexi-firms it’s often also a frustrating time-waster

The guarded world of financials

Financial planning, budgeting and the other related sub-disciplines have long been ensconced in a world of their own, with their own specialist practitioners, their own arcane language and a whole slew of “dark arts” concepts whose main function seems to involve ring-fencing the commercial value of their own professional domains.

This “magic curtain” approach to administering know-how is an ancient-but-effective tool for protecting vested interests, exclusivity agreements that began centuries ago with the guilds, and profit margins with an opaque relationship to actual value provided. Financial tools tend to target our perceptions that they’re “necessary”, but also tend to neglect considerations about whether they feel “desirable” or “useful”, or whether they are easy to use.

Historically speaking, the whole spreadsheet metaphor (it’s not a law of nature!) has been draped around pretty much everything associated with financials. Couldn’t it be done differently/more accessibly for us mere mortals?

A question of perspective

It’s important to know how to “frame” next-gen financial management software and services around users’ real needs and expectations – not least in light of international investors’ mounting scepticism about high-growth tech firms and the business models they use (whether explicitly or not). At the same time, such operations need to avoid the pitfalls of promising more than they are programmed to deliver.

Even the basic wording used can be indicative of intentions and mindset origins, along with indications of possible mismatches in expectations. Too much highlighting of words and processes like “budgeting” usually indicates origins in the traditional numbers world, or in fintech. Use of words like “modelling” is probably a good indicator of a more commercial/business perspective. Whereas a seemingly more mundane descriptive like “coding” can indicate a mindset stemming from the world of vanilla software – and perhaps an approach somewhat liberated from centuries-old standard thinking in the traditional world of supplier-centric finance and fintech.

Three groups of potential customers

There seem to be three different main target groups for forward-thinking financial management/planning tools:

- Professionalised groups with “territory” to defend – such as accountants, CFOs, Excel masters and financial software suppliers

- SMEs, business owner-drivers and non-accounting “amateurs” seeking access to financial management territory, to increase their capabilities, to achieve independence from partisan suppliers and to protect their businesses from the restraints of legacy thinking and traditional software configurations/limitations

- All the employees locked into using software solutions imposed on them by their employers and by the organisational structures of old-school, pre-transition enterprises.

Different strokes for different folks, but I’m mostly considering group b here – it’s probably where most of the new thinking and practical innovation is likely to take place.

The weak underbelly

The financials of startups, SMEs and other kinds of tech-driven innovators are often a weak point. In the white heat of innovation, the search for the “next big thing” and the delicacy of entrepreneurial aspirations, financials are rarely the primary driver in a new business entity, even though they may be crucial for measuring progress and success.

Nevertheless, financials are an important part of entrepreneurial ecosystems (EEs). You probably need easy-to-grasp financials for any investor pitch, as well as to measure the cost of customer acquisition and burn rates if your pitch was successful. You also need them for downright practical things like helping identify the point where your company can afford to start paying the founders a (real) salary.

Modelling alternative realities

Better/easier access to “financials as a tool” rather than “financials as a result” is a prime way to de-risk innovation as well as to support well-informed decisions and to optimise operations.

Numbers-driven stuff´ is not my field nor my comfort zone. However, a cursory search for tools in which us ordinary-but-ambitious businesspeople can use financials to drive strategy and decision-making – rather than just compile numbers – doesn’t seem to give a whole lot of choices.

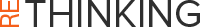

A new-generation spreadsheet purpose-built for budgeting

Dynamic modelling and “what if” explorations

Dynamic modelling is a term I know well – widely used in industrial, engineering and planning fields, as well as being familiar from CAD and CFD software, where it’s a normal, well-proven tool. Often loosely called simulations, dynamic modelling is a term widely used to cover integrating inputs from a range of sensors and other specialist sources to generate coherent, integrated situational awareness as well as data-driven visual depictions that enable users to get an immediate sense of the effects of any changes being considered. You can use these kinds of software tools to “imagine” complete machines, structures, environments and processes to see whether and how they might work. It’s interesting to see it applied to financials and “what if” scenarios about what would happen if you changed certain specifics about performance, resources, expenditure and revenue.

The Francis app seems to apply analytics to budgets and other spreadsheet animals to create simulations that help decision-makers understand how changes in setup and business model would affect specific metrics, and to provide overviews of how each financial item drives specified metrics. This would mean you can develop different scenarios for new ideas, good/bad cases and “what if” scenarios. These scenarios would always link back to the main financial actuals and stay updated, with dashboards to track outliers, trends and key metrics.

In Francis, everything speaks together. This should be the case in all professionally constructed spreadsheets – but rarely is. Links between business tools, budget files, scenarios, collaborators, and dashboards/reports make planning smarter than ever before. The standard kinds of links between line items and accounting structures are used to mould “what if” explorations as well as making actual planning smarter and better documented than is the traditional norm in smaller operations.

Other paths?

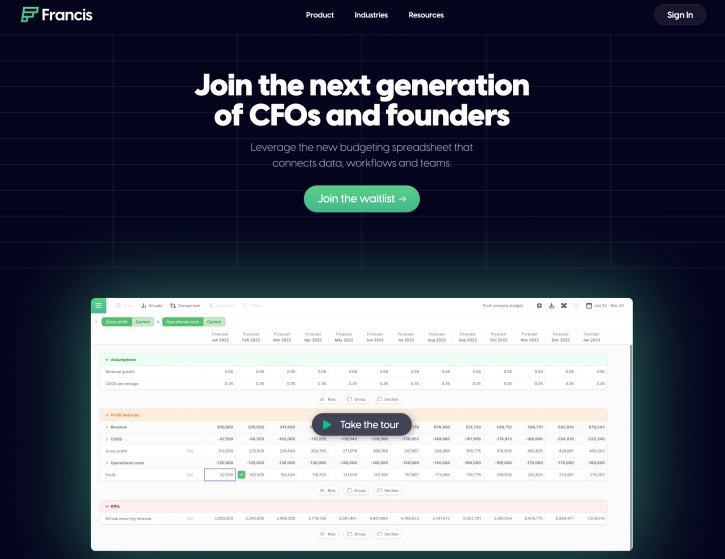

If dynamic spreadsheets are to remain the metaphor/narrative for financial modelling, there are also tools like Rows, allegedly reinventing spreadsheets so teams can do more – fast. In the Rows presenter video, the primary claim is really that they provide a framework in which spreadsheets actually work as intended/needed. Hardly disruptive …

They pitch their case well, but it’s still deeply immersed in the traditional world of spreadsheets, making it pretty hopeless for anyone who doesn’t speak that esoteric lingo. However nicely done, this is re-arranging the furniture within the fintech walls, but not redesigning the house.

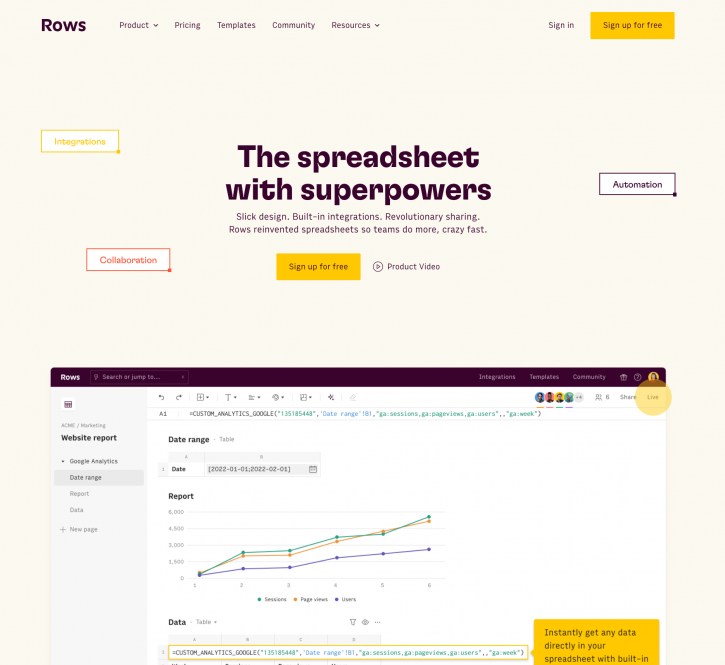

Another approach I found is in Workday, which pitches part of its finance, HR and planning system as a tool for adaptive financial planning, though within the larger-scale context of enterprise management cloud software. There are a lot of lofty claims, but the overall framework and narrative seem well stuck in the world of ERP software.

Francis seems to be just one example of a new generation of financial modelling and planning platforms that leverages the multiple benefits of dynamic budgeting in which all the available parameters – business tools, budgeting profiles, planning scenarios, dashboards/reports, etc. – are interlinked, in order to make practical financial modelling easier and planning smarter than before. This is pretty much the financial planning equivalent of 3D modelling and design software, and of currently flourishing “low-code/no-code” development software.

Technology-driven innovation in financial services can open up loads of new opportunities for greater agility, well-informed decisions and pre-emptive as well as responsive action. There’s even a book about it – Transformation Dynamics in FinTech! Crucially, such tools would probably need to be more accessible and easier to use for those non-specialists who need them as just one of many tools for multidisciplinary explorations of alternative commercial and financial realities.