Header Title

Moulding links from strategy to implementation

Strategy talk is (expensively) cheap – it’s implementing big new ideas that costs the really big bucks. How can a company move from strategy to implementation effectively?

Edicts from the top

There are often big difficulties involved in transitioning from top-down “the science agrees on …” assertions, C-suite aspirations and lofty strategy declarations, on the one hand, to practical action and point-of-impact strategy implementation on the other.

The “why” and “what” of purpose-driven business don’t always translate well into day-to-day operations, practical pitfalls and natural “self-protection” from all those involved in actually making any big idea work in a nitty-gritty world featuring computers that aren’t working, “have to pick up the kids” priorities and “why should I bother?” staff realities.

Consultancy careering, analysis paralysis, etc.

Furthermore, there’s a whole industry – often very high-prestige and extremely lucrative – involved in the development, discussion and presentation of business strategy. Careers are made in such heavyweight consultancy operations and corporate pivoting, whereas other people’s careers are often broken by any perceived failure to follow instructions to implement them. Consultancy operations – as well as business education courses – have a natural tendency to prioritise big analysis and dramatic reveals, rather than the slower, less glamorous plod at lower levels, and the more mundane aspects of implementing these hard-won and hard-wrung ideas.

Strategic implementation really just consists of doing fairly well-known things in the right order, and in context-sensitive ways. This should make it fairly easy to digitise, and more and more companies are beginning to address this market. The focus on implementation is also a way to transition from mere woke window-dressing to serious purpose, transparency and accountability.

Sustainability accounting

Starting specific, one approach lies in the desire to account for environmental impacts in the same way we account for financial performance. Vague assertions about “fewer emissions” and reduced environmental impacts aren’t enough. One of the key steps in implementing a strategy for net-zero emissions is to know the actual figures, and to document how much effect your planned changes are actually having. And whether an alternative approach might be better.

Claiming to be “the world’s first emission accounting engine”, Swedish-based Normative provides sustainability management software that serves as an emissions accounting engine. Normative automatically calculates a comprehensive, data-driven picture of a company’s climate footprint, including scope 1, 2 and 3 emissions, in accordance with the Greenhouse Gas Protocol (GHGP). This enables a company to account for its full value chain as well as to track progress over time. The big weakness, of course, is that Normative figures are only as good as the data inputted. Specifically, the Normative emission accounting engine calculates emissions based on a company’s spend, analysing the products purchased and using advanced data analysis to calculate the corresponding emissions. The overall idea and intentions sound good, but for a tech ignoramus the mechanical internals somehow sound a bit weak.

Backwards or forwards? From reporting history to risk prediction

Some of the first steps towards such digitisation of links between actions and reporting came from early generations of thinking about Corporate Social Responsibility (CSR), focusing on backwards-looking reporting on what had happened, so that efforts and results could be documented, compared and PR-bragged about – if successful.

CSR reporting is essentially backward-looking, reporting on what an organisation actually did, and aiming to make its activities somewhat accountable, post-facto. From about 2019 onwards, CSR reporting was followed – and in some more enlightened countries and some more progressive cases supplanted – by the wider and more rigorous concept of environmental, social and governance (ESG) criteria. With CSR reporting varying massively between different businesses and sectors, there had always been a general lack of credible, comparable metrics. ESG activity, on the other hand, is usually to a greater extent quantifiable and focused on making an organisation’s efforts in these fields more actionable – and also making digital tracking, implementation and remedial action easier.

The next shift will probably include movement towards more forward-looking prediction, in the form of risk assessment and pro-active action. According to the 2020 Status Report published by the UK government’s Task Force on Climate-related Financial Disclosures (TCFD), large companies and financial institutions in the UK will now have to come clean about their real-world exposure to climate risks, with recommendations that such climate risk reports become mandatory by 2025. The UK will thus become the first G20 country to do so, with disclosure rules covering a significant portion of the national economy, as part of a targeted transition to a net-zero norm for business activity. In a similar vein and as a similar acknowledgement of unknown risk and the powerlessness of single-nation decision-making, thirty-three countries have now formally acknowledged the existence of the global climate crisis by declaring a climate emergency, with New Zealand the most recent, in December 2020.

Other countries will (probably) have to follow suit … and all this is one of many clear pointers that strategy (and in particular its implementation) can no longer remain in the restricted realm of C-suite shelf-decoration binders and consultant PowerPoints. The perspectives involved here are well beyond the realm of “comfort zone thinking”, as illustrated by The Children’s Investment (TCI) fund, which uses USD $30 billion of investments to “force change on companies who refuse to take their environmental emissions seriously”. In a similar vein, in March 2021 major UK-based pension funds that own assets worth GBP 870 billion committed to cutting the carbon emissions associated with their portfolios to net zero by 2050 – or earlier, if possible. These pledges were coordinated by the London-based Institutional Investors Group on Climate Change, which has launched a set of tools that demonstrate how investors can achieve net-zero portfolios.

Strategy implementation going/gone digital

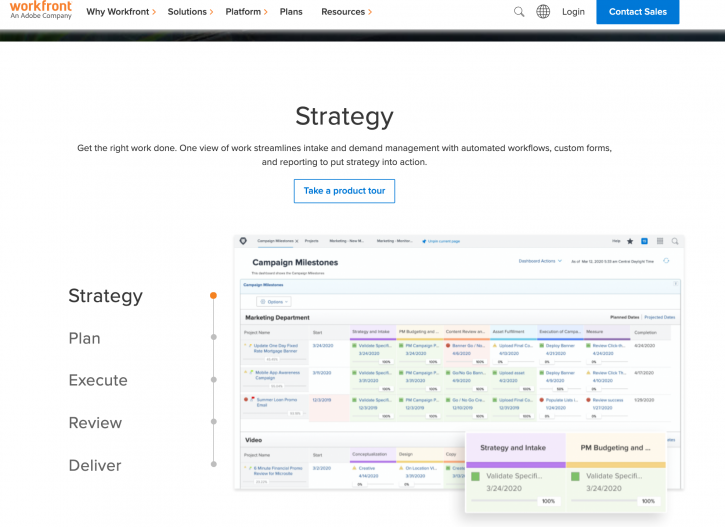

One company that tackles/tackled this market for digital strategy implementation is Workfront – so successfully it was acquired by Adobe in November 2020. Billed as an enterprise work management platform that can help companies plan, predict, collaborate, evolve and deliver their best work, the software joins up the dots to provide efficiency, visibility and cohesiveness. Workfront presentations seem to feature a lot of stuff about the nuts and bolts of “how” and thus focus on the software user end – rather than the strategy motor – but they certainly seem on the way to providing a tool to connect strategy to delivery. And now within a more devolved, integrated context within the so-widely used Adobe universe.

One company that manages to storyboard this whole strategy implementation scenario strikingly well is DecideAct – using visibly Scandinavian videos like this, oozing with grizzled seniority and shirt-sleeved experience against dark shadows, brass lamps and massive old timbers – delectable Scandi Noir meets strategy narratives!

DecideAct apparently provides a digital solution designed to help and enable companies and other organisations achieve their strategic goals by leveraging traditional manual implementation and follow-up of strategy with the help of a cloud-based Strategy Execution Management (SEM) platform, along with proprietary strategy implementation platform software.  DecideAct itself reckons the SEM market has at least the same potential as CRM – which currently boasts an annual turnover of USD 40 billion (according to them and statista.com) – and boldly aims for the no.1 spot in that stratospheric market! In November 2020, DecideAct announced it was going public on Nasdaq First North, so they must reckon they’re doing something right.

DecideAct itself reckons the SEM market has at least the same potential as CRM – which currently boasts an annual turnover of USD 40 billion (according to them and statista.com) – and boldly aims for the no.1 spot in that stratospheric market! In November 2020, DecideAct announced it was going public on Nasdaq First North, so they must reckon they’re doing something right.

Our vision is to modernize strategic leadership through technology

Proscriptive steps

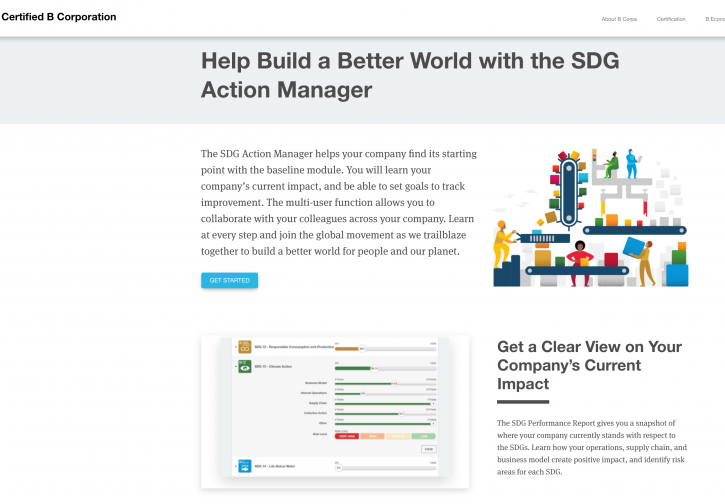

There’s also another flavour of “strategy-to-implementation” tool, more to keep tabs on strategic goals about which there is an established external consensus. The SDG Action Manager was developed by B Lab (the non-profit

certification body behind B Corps, now over 3,500 in number) and the United Nations Global Compact, as part of B Lab efforts to redefine the role of business in society.

This free, web-based impact management tool is designed to help companies set business goals, take SDG-compliant action, and track a company’s progress towards the UN Sustainable Development Goals. Which is kinda’ like CSR reporting – though on a much larger scale, and in relation to a globally agreed set of goals.

Take action. Track progress. Transform the world.

Focusing on a subset?

In every field of business and technology, there’s a natural tendency to zero in on the technical details of one particular market, product range, technology or type of use. Strange how everybody seems to think their particular niche is unique, infinitely impenetrable and wholly wonderful …

But underneath the entire discourse about CSR/ESG/SDG compliance and strategy implementation software is a whole field of data analysis and reporting. In this mysterious world of big data and pattern analysis, ESG- or strategy-specific bytes are just one particular flavour amid a zillion possibles …

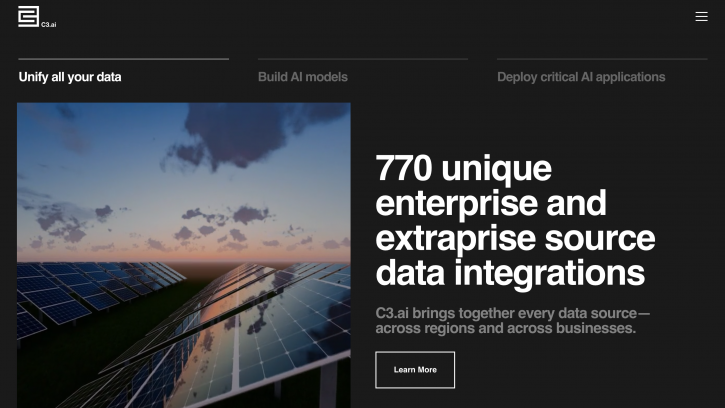

There is, of course, Amazon Web Services as the current apex predator. While enterprise AI software company

C3.ai sets out its new-kid-on-the-block corporate shingle as bringing together every data source, integrating virtually all kinds of data at scale, and providing 20+ pre-configured AI applications to optimise critical business processes in specific industries and segments.

So it’s perhaps hardly surprising that c3.ai ratched up a blockbuster IPO on Wall Street in December 2020.