Header Title

Rethinks for the shape of aviation?

Aircraft design has been based on pretty much the same conceptual mindset and engineering truisms for yonks. Is it time for a shape-shifter rethink?

Tubular traditions

Almost from the beginning, aircraft have consisted of a long, more-or-less tubular structure for cargo (human or otherwise), with some kind of airfoils sticking out from the sides to provide the lift needed to get the whole shebang off the ground.

With loads of really-only-marginal changes – fuselage cross-section, wing sweep, new materials, streamlining, different control systems, propulsion technology and engine locations – this basic shape became pretty much the norm for all aspects of conceptual thinking about aircraft, and has remained so for a long time, in engineering terms. Could that be about to change?

Marginally minded

Commercial aviation innovation and technical development have long been limited to marginal, incremental improvements on existing design types, with “outlier” configurations gradually falling by the developmental wayside, and smaller companies struggling in niche markets.

The combination of strategic consolidation in the aviation industry and the vast cost of technical development and testing as well as manufacturing technology (think composites and high-bypass turbofan engines) has meant the Airbus/Boeing commercial aviation duopoly has more or less taken over. Companies like ATR and Embraer are strong but really only niche players, while the once-powerful Bombardier has been dropping regional jets, selling off DHC and shrinking down to biz-jets alone. There are also Chinese and Russian attempts to gain an aviation toehold, but their impacts on world markets and technological innovation seem unlikely to impinge upon the mainstream.

For many years, commercial aircraft design has featured constant size creep based on the combined requirements for rightsizing on each individual route, cost-per-seat-mile efficiencies based on maximum traffic volume and the constant thirst for greater fuel efficiency and reductions in planet-toxic emissions. For a long time, all the popularly bandied performance numbers have been in “x% better than” or “x% savings on” formats – incremental engineering. The pinnacles of this long-lived twin-engine wide-body development mindset to date are the current Airbus A350 XWB family and the forthcoming (much-delayed) Boeing 777X series.

For many years, commercial aircraft design has featured constant size creep based on the combined requirements for rightsizing on each individual route, cost-per-seat-mile efficiencies based on maximum traffic volume and the constant thirst for greater fuel efficiency and reductions in planet-toxic emissions. For a long time, all the popularly bandied performance numbers have been in “x% better than” or “x% savings on” formats – incremental engineering. The pinnacles of this long-lived twin-engine wide-body development mindset to date are the current Airbus A350 XWB family and the forthcoming (much-delayed) Boeing 777X series.

Shape shifting

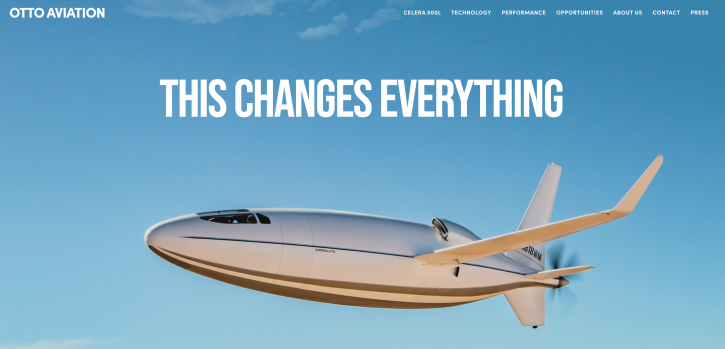

But there may be changes on the way. Unlike any aircraft design seen before, the tubby, almost pod-shaped Celera 500L is a strange-looking, six-passenger, all-composite pusher-engine aircraft built by Otto Aviation. The company was carrying out undergoing prototype testing during the summer of 2020, and hopes the aircraft will democratise private aviation and make chartering the Celera 500L on a par with commercial airline ticketing in terms of cost.

The company itself focuses the conceptual narrative on laminar flow surfaces that result in drag reductions of up to 59%, seemingly ridiculous transcontinental range and remarkable multi-fuel efficiency (despite the nowadays less-than-usual piston-engine powerplant), as well as exceptional cabin comfort because of the revolutionary shape. For a slightly more impartial account, there’s a good (though jarringly presented!) third-party explanation on a YouTube film here. And a decidedly sceptical analysis of the alleged performance numbers, from Flying Magazine, here.

The company itself focuses the conceptual narrative on laminar flow surfaces that result in drag reductions of up to 59%, seemingly ridiculous transcontinental range and remarkable multi-fuel efficiency (despite the nowadays less-than-usual piston-engine powerplant), as well as exceptional cabin comfort because of the revolutionary shape. For a slightly more impartial account, there’s a good (though jarringly presented!) third-party explanation on a YouTube film here. And a decidedly sceptical analysis of the alleged performance numbers, from Flying Magazine, here.

What makes this counter-intuitive aircraft design particularly interesting is that it features unusually many innovative design solutions and technology innovations in one delightfully weird airframe (seven USPTO patents on the design alone, apparently). The company is claiming to be ushering in a new era of aviation through paradigm-shifting performance and operating economics. According to Otto Aviation itself, the Celera design will also provide an 80% reduction in carbon emissions compared to a comparable business aircraft, claiming it to be it “the most environmentally friendly airplane in its class.” This is just one indication of radically new parameters in any future discussion of aircraft design – from mere shape to operational context, and from performance to impacts.

It doesn’t just outperform in every category. It crushes it.

Going v-shaped

A scaled flight model of another possibly significant shape-shifted innovation underwent successful flight testing in the summer of 2020. Developed by the Faculty of Aerospace Engineering at TU Delft in the Netherlands, the Flying-V is a design for a long-distance aircraft that makes significant breakthroughs in energy efficiency as a result of design, rather than engine technology.

The design integrates the passenger cabin, the cargo hold and the fuel tanks into the wings, creating a spectacular v-shape. A pressurised oval-shaped cabin enables efficient structural engineering, with sufficient design freedom to allow for effective aerodynamic shaping as well as low weight relative to the number of passengers. As a result, estimates are that the Flying-V would consume 20% less fuel than an Airbus A350 – currently the most advanced passenger aircraft commercially available – for any equivalent route. The oval-shaped cabin also allows for new interior layouts and functionalities, significantly improving the customer experience for those of us most used to cattle-truck tubes.

This breakthrough design has already caused a big buzz in commercial aviation circles because it also addresses the core issue of passenger volume and mainstream operations based at commercial airports. It provides significant changes while fitting into existing infrastructure – which is a big selling point.

Existing configurations only allow incremental, minor improvements

Zero – and other new design parameters

Meanwhile, Airbus is undertaking somewhat similar shape and configuration experiments in the “blended-wing body” design shown as one of the three Airbus ZEROe design concepts – with the huge difference that Airbus ZEROe aircraft are mostly defined by their zero-emissions propulsion technology. Airbus claims that replacing traditional planet-toxic propellants with zero-emission hydrogen by 2025 is a commercially viable proposition.

That’s probably also why a well-funded market entrant like ZeroAvia Inc is working to bring the first practical zero-emission powertrain to the market. A plane fitted with the ZeroAvia hydrogen fuel cell technology made its first flight in the UK in September 2020. This technology is particularly attractive because of the big power-to-weight challenges involved in electric flight. Energy density — the amount of energy stored in a given system — is the key metric, and traditional jet fuel still provides about 40 times more energy than virtually any battery that’s just as heavy.

Research indicates that aviation causes about 3.5 % of humanity’s contribution to climate change The overall need to decarbonise will therefore also play a big role in redefining future parameters for aircraft design – whether conventional in appearance or not.

Mould-breaking time?

These three examples of recent design innovation seem to be individual indicators of possible new paths for aviation design. However, there also seems to be a much more comprehensive groundswell of rethinking, reconfiguration and new aircraft designs coming down the pike. For multiple, inter-connecting reasons.

We may recently have seen the beginning of the first possible serious doubts about the viability of the once all-mighty Boeing manufacturing model. In December 2020, reports about defects arising on the Boeing 787 Dreamliner production line emerged, prompting the FAA to start reviewing quality-control lapses in the Boeing manufacturing setup stretching back almost a decade. This is an eloquent reminder that design advances aren’t much use unless manufacturing and quality assurance capabilities are able to keep up.

In 2020, the entire framework of business model assumptions that underpin commercial aviation as we know it has been seriously shaken, with passengers and revenue plummeting to almost non-existent. The International Air Transport Association (IATA) estimates that airlines will lose as much as USD 157 billion before the effects of the current pandemic finally tail off.

This all probably makes 2020–21 the most auspicious time ever for big rethinks of commercial aviation, right across the size and range spectra.

Opportunity knocks

At the same time, we’ve recently seen a whole series of different technology breakthroughs that together make it significantly easier to rethink aircraft design than at any other time in history.

The price of entry to the (low end of) both the general and commercial aviation markets has been drastically reduced because advanced software like the Onshape cloud-based product development platform and simulations like Simulia from Dassault Systèmes now mean aircraft can be designed, engineered, configured and then even flight-tested virtually – before even cutting any metal (or composite).

Relatively new capabilities like CFD engineering, composite materials and 3D printing make it much quicker and easier to get prototypes ready and engineered for cost-effective manufacture, while small, fuel-efficient and reliable powerplants of all kinds are now available off the shelf to replace the big, bulky jet fuel-guzzlers so recently the design norm.

Going electric

Electric motors and hybrid drive-trains have also become easily available, with a growing number of commercially viable aircraft in which the innovation is centred on powertrains and energy storage systems. Well-known examples include the Texas Aircraft eColt – an electric LSA aircraft with next-generation lithium-sulphur batteries that feature a 400-Wh/kg energy density and provide a two-hour, 230-mile range – and the eFlyer 2/4 from Bye Aerospace, which as of November 2020 already had orders amounting to 711 aircraft. Not an insignificant number.

For commercial operations, there is now also an electric-powered Cessna 208B Grand Caravan, while Tecnam is developing the P-Volt all-electric short-to-medium-range passenger aircraft, and VoltAero in France is working on the Cassio family of hybrid electric aircraft for certification to the European EASA CS23 general aviation specification.

Going backwards, Harbour Air in Canada is now operating its wonderfully ancient DHC-2 Beaver fleet with magniX electric propulsion systems – a technology ideal for retrofitting into many existing aircraft designs.

In the remarkable Faradair Beha M1H, innovative design featuring a triple box wing combines with magniX hybrid-electric propulsion (providing a carbon-neutral operating footprint) in a short take-off and landing 18-passenger regional air transport solution that the company declares to be the world’s most environmental aeroplane. This ups the ante on the Celera 500L, and specifically targets regional commercial operations.

Electrification is set to have as dramatic an impact on aviation as the replacement of piston engines by gas turbines. We are at the dawn of the third era of aviation.

Air mobility and the multiplicity

Aviation accounts for more than 12% of total transport emissions. Despite new generations of more fuel-efficient engines, these emissions are growing at the fastest rate, and set to double by 2050. Released at high altitudes, aviation emissions have 2–4 times the global warming impact of comparable emissions at ground level. This is now driving a regulatory and commercial push to move to zero-emission aircraft, flying lower and more point-to-point, as well as making use of existing smaller airports – of which there are many in the US, the world’s largest and most-developed market for both commercial and general aviation. Outside the US, the aim is more about the market for regional connectivity travel between locations unserved by high-speed rail networks and regional airline services.

That’s why, on top of all these new potential engineering avenues, there’s also a burgeoning innovation cauldron centred around eVTOL aircraft and transitioning multicopters, under the collective monikers of Urban Air Mobility (UAM) and Regional Air Mobility (RAM). Basically, these correspond to on-demand “air taxis” carrying just a few passengers at a time or (somewhat) larger aircraft designed for regional commercial operations.

In this new field, there is a lot of competition to create the first commercially viable aerial vehicle of its kind. According to some sources, there are currently 300 or so eVTOL projects in progress around the world. There’s a good May 2020 overview of many current designs here, but such a list is in constant flux as these startups go through the normal commercial birthing hindrances (and often bite cashflow dust en route). To be realistic, long-term survivors and commercial successes will probably be much smaller in number.

Joby Aviation in the US seems one of the companies most likely to get an airframe certified early; it’s already many years into eVTOL development, and has significant financial and manufacturing backing thanks to a recent deal with Toyota. Another well-funded player – specifically targeting the regional air mobility market, where the bigger revenue (presumably) lies – is Lilium in Germany – the engineering and aerodynamics of the Lilium Jet, involving 36 electric ducted fans in four unusually elegant tilting banks – are third-party explained below.

There’s also the all-electric, octo-engined VA-1X from Vertical Areospace in the UK. Although still at the prototype stage, according to the company itself, the VA-1X is on course to EASA certification and to start commercial flights in 2024. Vertical mentions regional operations, but also describes it as an air taxi – and it is only a five-seater.

By contrast, the Vertiia design from AMSL Aero in Australia gets round the limitations of the air taxi business model by being purpose-built for the aeromedical market, which is uniquely important in the vast expanses of that country.

Companies like Lilium and Joby Aviation have been notably successful in raising considerable investment funds for their efforts because these designs represent a possible slice of a completely new transport market, rather than mere extensions/tweaks of known design and engineering ideas and providing marginally different new capabilities in existing markets.

The stormy sieve of certification

However, seductive design and technical innovation aren’t enough. The big underlying question in all these design fireworks and technical breakthroughs lies in official certification. A company – whether mega or startup – can design and innovate aviation vehicles until it’s blue in the corporate face, but in passenger-carrying aviation (in particular) there’s a gargantuan step between engineering and manufacturing development (EMD) and commercial service. It’s called certification – and it’s complex, time-consuming and mind-bogglingly expensive.

This is a particularly prickly issue in the current climate where certification processes and technology implementation are under intense scrutiny, partly as a result of the calamitous Boeing 737 MAX certification fiasco-cum-scandal. If one of the world’s largest, most technically advanced and most experienced aircraft manufacturers loses billions of dollars on certification snafus, incompetence and issues, one might be a little sceptical about how inexperienced startups are going to fare with putting radically new aircraft designs into the same operating space. Especially when the new Aircraft Certification Reform and Accountability Act currently passing through the US Congress makes certification even more onerous.

To the layman, such small, multi-engined eVTOL designs may look decapitatingly lethal. However, these configurations have the big advantage of having no single point of failure – unlike a helicopter where the loss of power or rotor blade damage can be catastrophic. This means forthcoming eVTOL designs should be at least as safe as existing aerial vehicles, with the big extra benefits of being quieter, cleaner and (seemingly) more environmentally responsible. These advantages mean new-generation eVTOL aircraft seem likely to gain some kind of newly configured regulatory approval, but it’ll almost certainly only be for certain specific tasks and services.

Selling an idea to sell a plane

The big issue lies in the business model. Can an operator sell enough seats at a price sufficient to achieve a reasonable/commercially acceptable ROI? And do so consistently once any novelty value has worn off?

As of April 2020, passenger numbers at London Heathrow were down by 97%. Airbus chief executive, Guillaume Faury, described the Covid-19 pandemic as “the gravest crisis the aerospace industry has ever known”. If the whole business model for high-density air travel and commercial aviation gets permanently upended, there may therefore be a case for much smaller-scale links with less density and less contact, using smaller aircraft niche-marketed as anti-contagion, lower-risk “bubbles”, contrasting with traditional perceptions of pack-’em-in mass-market air travel. It would be a remarkable turn-around if aviation design becomes driven by a worldwide fear-of-disease-spreading narrative, rather than traditional concepts of visual beauty or commercial cost-effectiveness criteria.

But that’s an outlier scenario– hopefully. Any significant rethinks about aircraft design need to address the business model issue – because radical, “big stuff” innovation often requires a major dollop of upfront expenditure and infrastructure costs. UAM has been considerably overhyped and journo-sensationalised – the passenger numbers simply don’t stack up against the infrastructure investments needed and operating costs involved. And especially so if eVTOL passenger numbers are in dozens rather than old-school hundreds. Even simple steps like reconfiguring air bridges and runways (for the jumbo generation, remember?) is hugely expensive – because it has to be done everywhere for the business model to work.

That’s why the proverbial elephant in the room with customer-facing UAM services and the whole eVTOL market segment – and whether it will blossom or wither – lies with the infrastructure question, and with the huge air traffic management challenges of putting so many machines into the air above any urban area. The highly fractionated infrastructure needed for high vehicle volume/low passenger numbers represents a big danger/risk for safety as well as general aviation credibility. It’d be kinda’ like manufacturing cars before there are any roads, or any agreements about how to drive on them – which side? turning rules? – with the added mega-complexities of a third dimension, and a whole lot farther to fall.

Mobility in the third dimension isn’t just about nifty hardware and breakthrough technology configurations – it requires crazily reliable seamless integration of many different technologies that currently often reside in ring-fenced silos. Examples include avionics and flight control systems, detect and avoid (DAA) capabilities, inflight connectivity, air traffic management systems, communication links, smart sensors, different Global Navigation Satellite System (GNSS) precision locating constellations and a plethora of other navigation aids, as well as flight management and monitoring systems inside the aircraft and at many interlocking points on the ground. This is an extremely complex electromagnetic environment in which changes in any one element can have wide-ranging knock-on effects, and where aircraft suppliers will have to demonstrate and document resistance to spoofing, interference and coexistence threats. UAM suppliers will probably need to be better at digital integration and systems design than at any of the conventional aviation-linked skills!

The logistics of handling 1,000 five-seater vehicle arrivals and departures every hour, round the clock (as projected for a Uber Sky Tower) are pretty daunting. This is why a company like Lilium needs to design, finance and deliver commercially viable, scalable “vertiports” – the first is (apparently) planned for Orlando, Florida, for opening in 2025 – before its aviation vehicles have any realistic chance of mainstream commercial implementation. Similarly, Skyport designs would be pivotal for the kinds of flying taxis that Uber Elevate (sold to Joby Aviation in December 2020) currently wants to operate as part of an on-demand transport mix. And then there’s all the also-expensive and investment-heavy “invisible” stuff – traffic management, radar systems, communications, collision avoidance technology, etc. While pre-autonomous pilot costs and maintenance are disproportionately high because they’ll have to be spread over so few passengers.

All this means the design of the aircraft itself is only the pimple on the ogre’s nose. Good, responsible design involves much more than just gobsmacking visual appearance. Without the necessary infrastructure in place and without the air traffic management issues solved, and without any obvious business model or convincing revenue-against-costs calculations, many of the exciting new aircraft designs currently emerging are probably developmental dead ends, and on-demand aviation services for consumers seem a long way away.

Ultimately – individual design phenomena are only a distraction from the real issues. In modern technology, the deciding factor usually lies in the connective systems and technologies, rather than any individual design. So perhaps the best investment bet in all this discussion of aircraft design isn’t even an aircraft – but instead the software needed (a prerequisite, in fact) as a digital backbone for UAM operations. Such as the AerOS digital mobility platform developed jointly by the big boys and girls at Bell and Microsoft, to provide the joined-up Mobility-as-a-Service (MaaS) experience essential for commercial success.